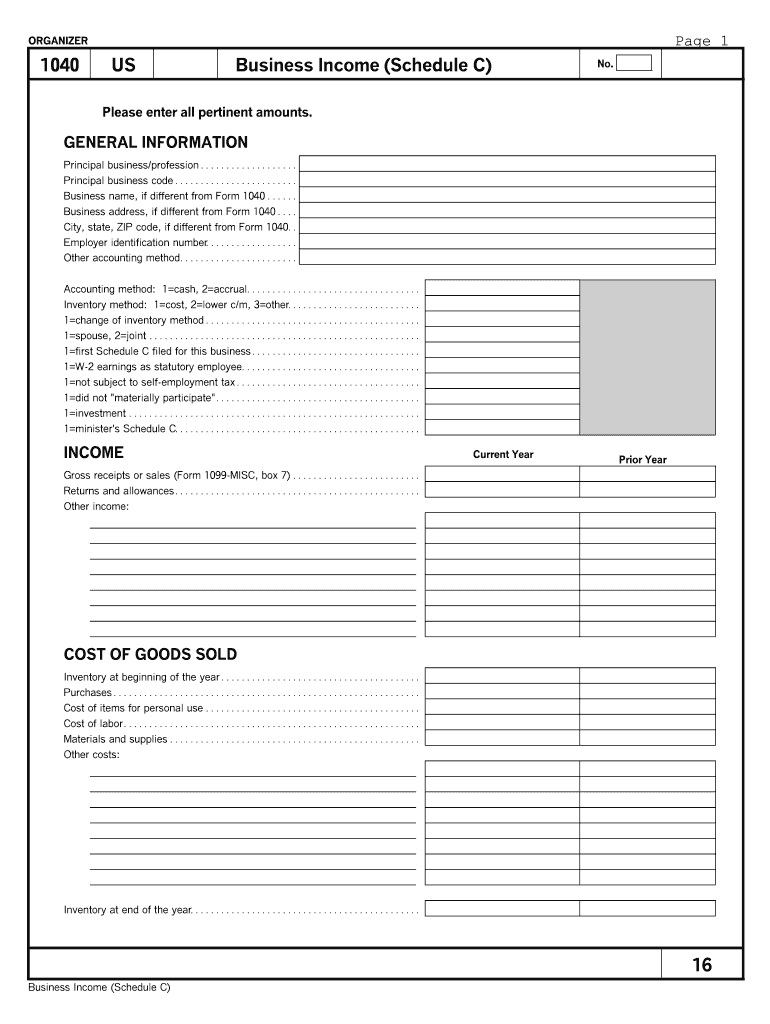

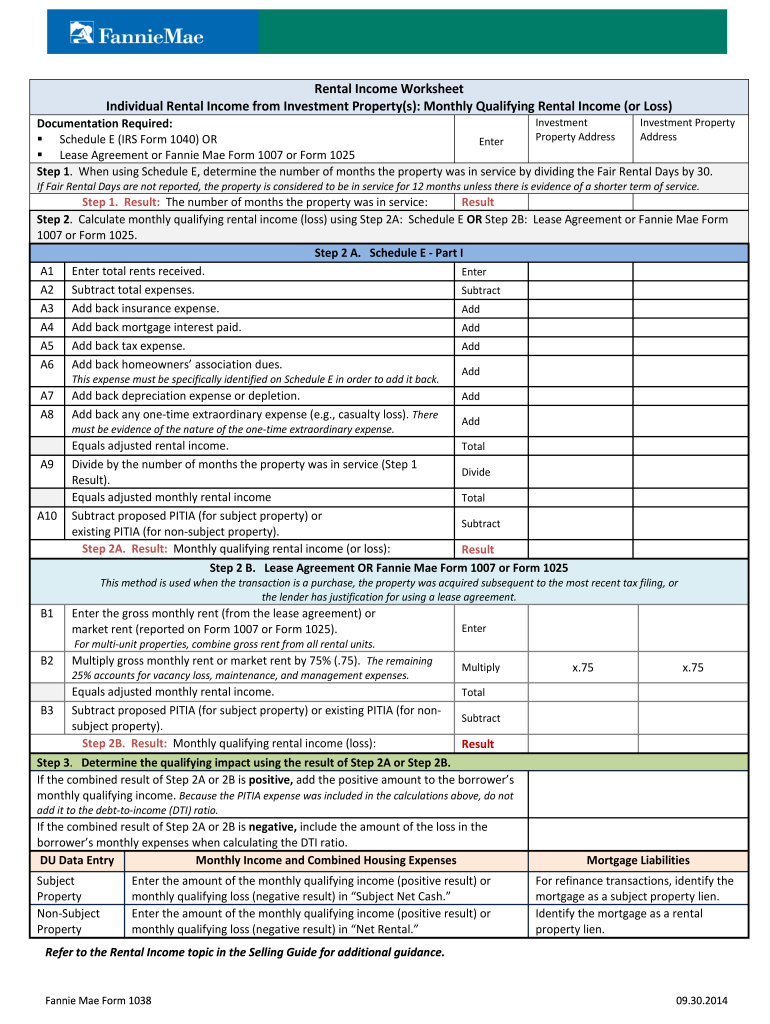

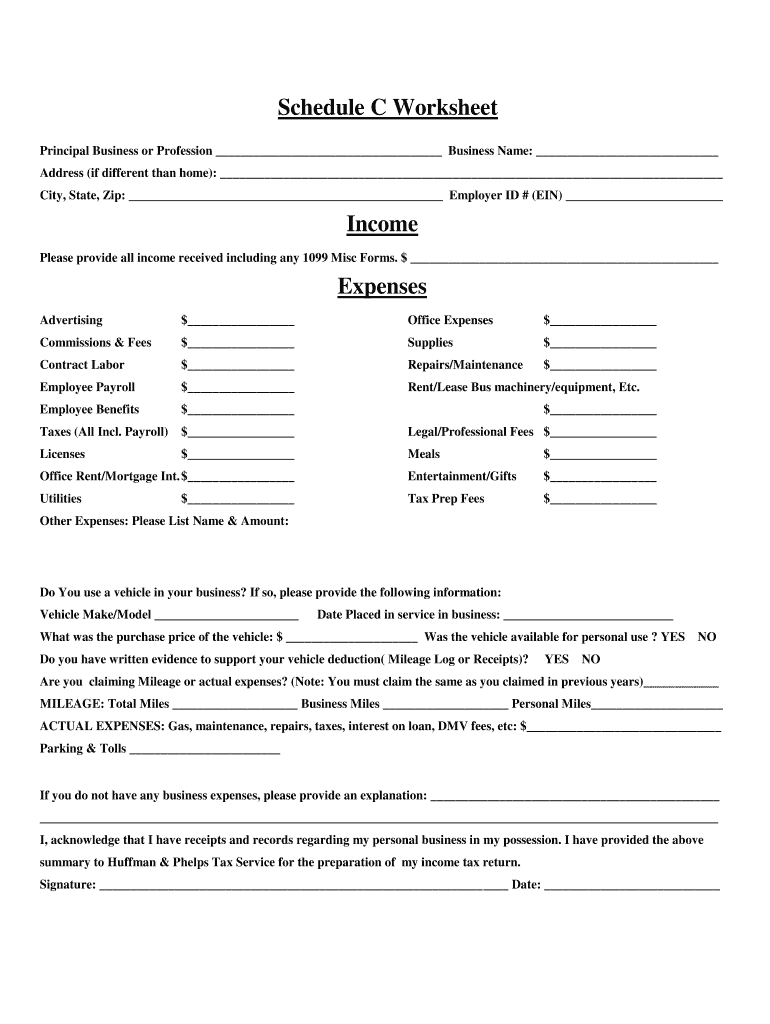

A Schedule C Income Calculation Worksheet is a tool used by self-employed individuals to accurately calculate their business income and expenses for tax purposes. This worksheet is an essential part of filing taxes when you are self-employed, as it helps you determine your net profit or loss from your business activities.

When filling out the Schedule C form, you will need to provide detailed information about your business income, expenses, and deductions. The Income Calculation Worksheet helps you organize this information in a clear and systematic way, making it easier to report your business income accurately.

Schedule C Income Calculation Worksheet

How to Use a Schedule C Income Calculation Worksheet?

Using a Schedule C Income Calculation Worksheet is simple and straightforward. To start, gather all your business income records, such as sales receipts, invoices, and bank statements. Next, list all your business expenses, including rent, utilities, supplies, and any other costs related to your business operations.

Once you have gathered all the necessary information, input the income and expense amounts into the designated sections of the worksheet. The worksheet will automatically calculate your net profit or loss based on the information you provide. This final figure will be used to fill out the Schedule C form when filing your taxes.

Benefits of Using a Schedule C Income Calculation Worksheet

One of the main benefits of using a Schedule C Income Calculation Worksheet is that it helps you stay organized and keep track of your business finances throughout the year. By regularly updating the worksheet with your income and expenses, you can easily monitor the financial health of your business and make informed decisions to improve profitability.

Additionally, using a Schedule C Income Calculation Worksheet can save you time and reduce the risk of errors when filing your taxes. By having all your financial information in one place, you can quickly and accurately report your business income and expenses, minimizing the chance of audits or penalties from the IRS.

Download Schedule C Income Calculation Worksheet

Income Worksheet Fill Out Sign Online DocHub

Schedule C Expenses Worksheet Fill Out Sign Online DocHub

Use This Handwriting Worksheet Generator To Create Schedule C Income Calculation Worksheet