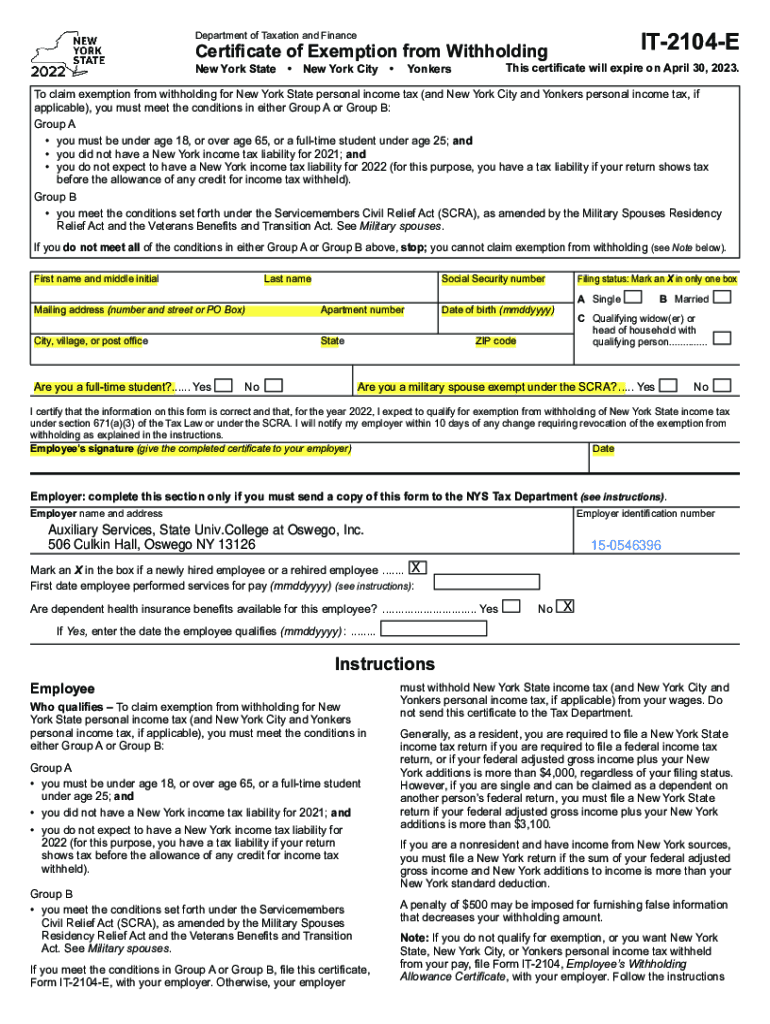

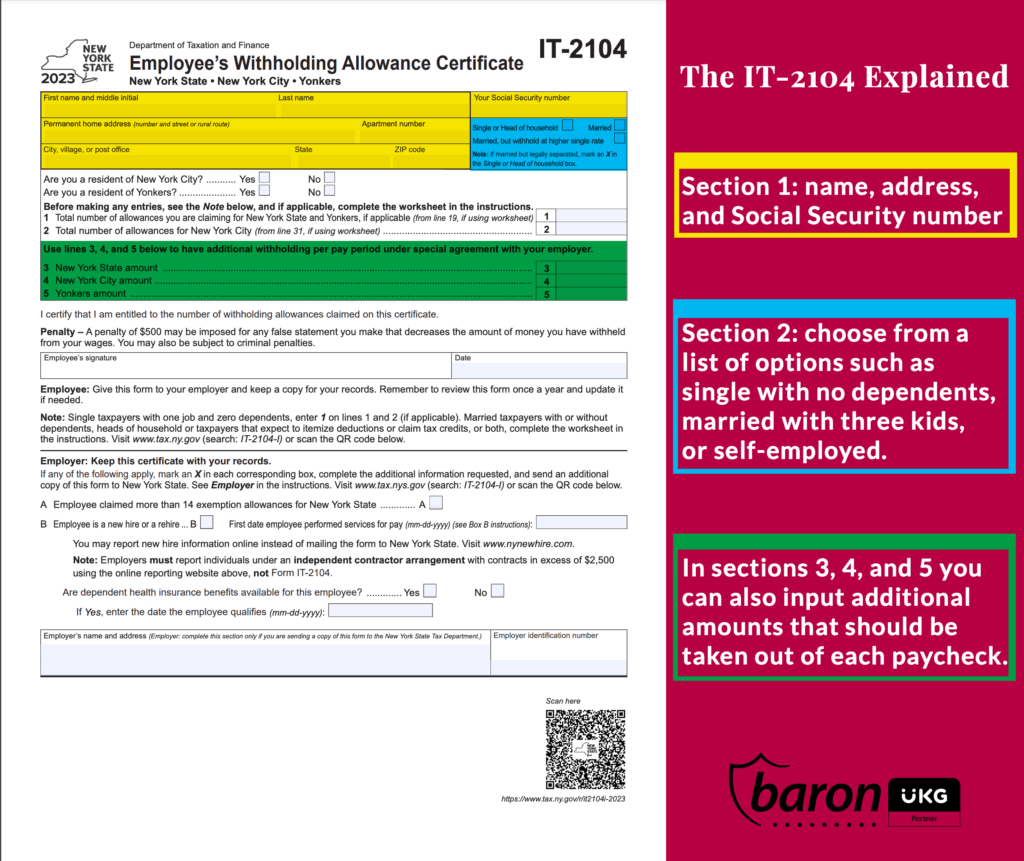

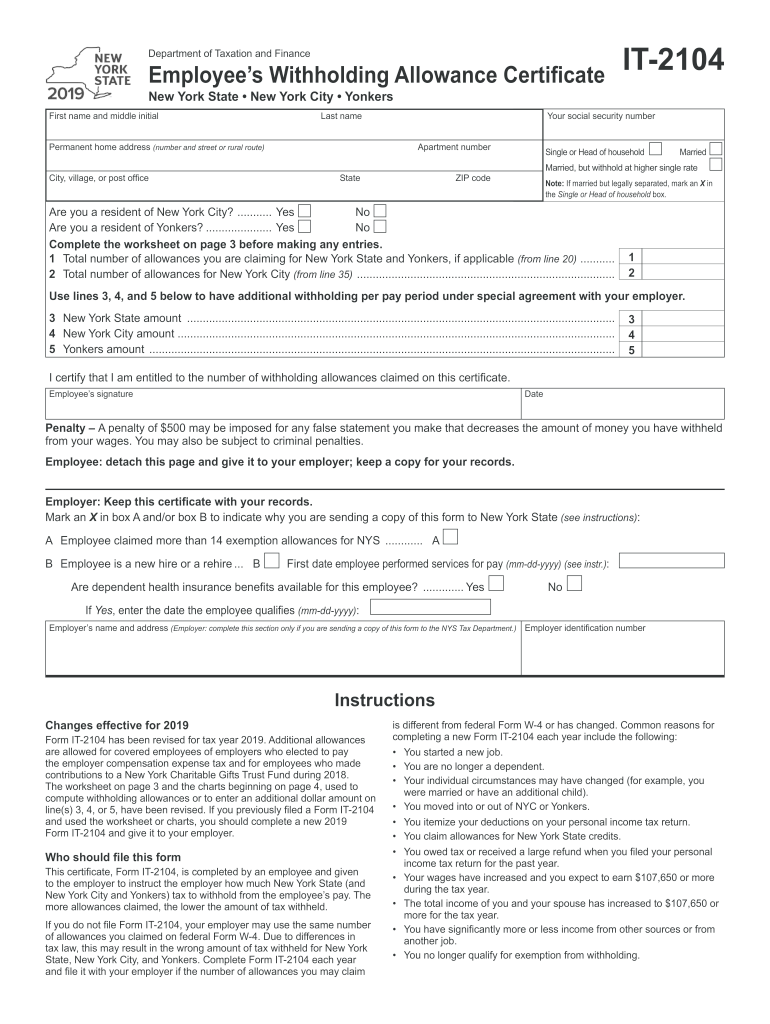

The IT-2104 Worksheet 2026 is a crucial document used by employees to calculate their withholding allowances for New York State income tax. By accurately filling out this worksheet, employees can ensure that the correct amount of tax is withheld from their paychecks, preventing any surprises come tax season.

It is important for employees to update their withholding allowances whenever there is a change in their financial situation, such as getting married, having a child, or taking on a second job. Failure to update this information could result in under or over-withholding, leading to potential penalties or a lower tax refund.

It-2104 Worksheet 2026

How to Fill Out the IT-2104 Worksheet 2026

When filling out the IT-2104 Worksheet 2026, employees will need to provide information such as their filing status, number of dependents, and any additional withholding amounts they wish to claim. It is essential to carefully follow the instructions provided on the worksheet to ensure accurate calculations.

Employees should also keep in mind any deductions or credits they may be eligible for, as these can impact their withholding allowances. By taking the time to fill out the IT-2104 Worksheet 2026 correctly, employees can avoid any potential tax headaches and ensure that they are paying the right amount of tax throughout the year.

Consulting with a Tax Professional

If employees are unsure about how to fill out the IT-2104 Worksheet 2026 or have complex tax situations, it may be beneficial to consult with a tax professional. A tax professional can provide guidance on how to accurately complete the worksheet and ensure that employees are maximizing their tax savings.

Overall, the IT-2104 Worksheet 2026 is a valuable tool for employees to manage their tax withholding and ensure they are meeting their tax obligations. By understanding the purpose of this worksheet and filling it out correctly, employees can take control of their tax situation and avoid any unnecessary surprises.

By following these guidelines and keeping the IT-2104 Worksheet 2026 up to date, employees can stay on top of their tax responsibilities and avoid any potential issues down the line.

Download It-2104 Worksheet 2026

IT 2104 Step by Step Guide Baron Payroll

It 2104 Worksheet Fill Out Sign Online DocHub

Use This Handwriting Worksheet Generator To Create It-2104 Worksheet 2026