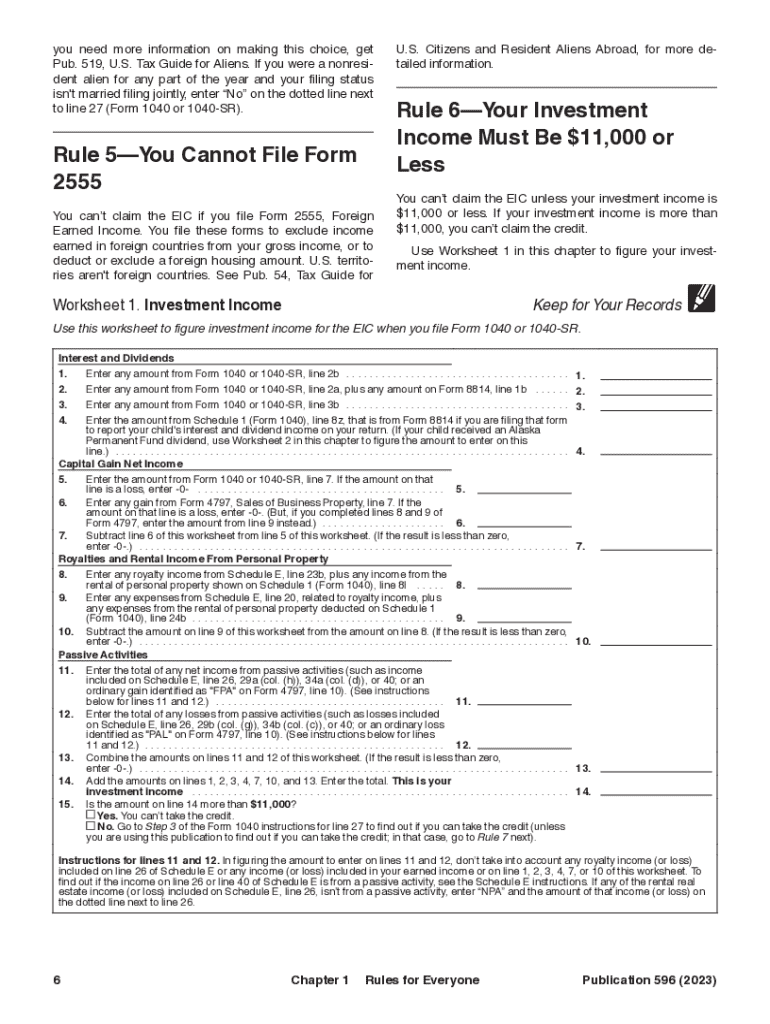

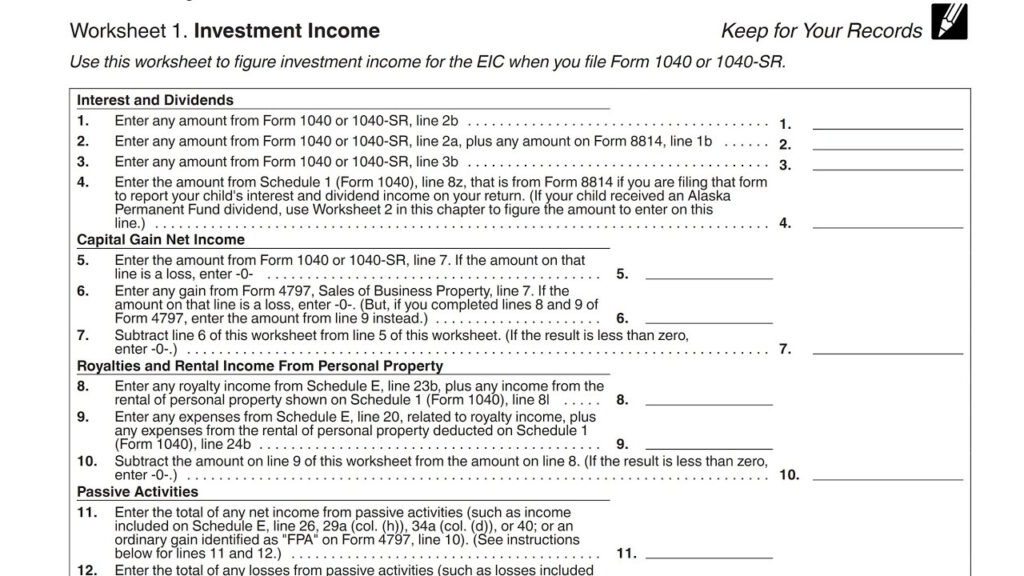

IRS Publication 596 Worksheet 1 is a helpful tool provided by the Internal Revenue Service to assist taxpayers in calculating their Earned Income Credit (EIC). The EIC is a refundable tax credit for low to moderate-income working individuals and families. This worksheet is designed to help taxpayers determine their eligibility for the EIC and calculate the correct amount of credit they may be entitled to.

The Worksheet 1 in Publication 596 guides taxpayers through a series of steps to determine their filing status, number of qualifying children, and earned income. It also helps taxpayers calculate any adjustments to their earned income and determine if they are eligible for the EIC. By following the instructions in Worksheet 1, taxpayers can accurately calculate their EIC and claim this valuable tax credit on their tax return.

Irs Publication 596 Worksheet 1

How to Use IRS Publication 596 Worksheet 1

To use IRS Publication 596 Worksheet 1, taxpayers should first gather all relevant financial information, including their income, expenses, and any other relevant tax documents. They should then carefully read through the instructions provided in the worksheet and follow each step as outlined. Taxpayers should pay close attention to details such as their filing status, number of qualifying children, and any adjustments to their earned income.

By completing Worksheet 1 accurately and thoroughly, taxpayers can ensure that they are claiming the correct amount of EIC on their tax return. This can help them maximize their tax refund and avoid any potential issues with the IRS. Additionally, using Worksheet 1 can help taxpayers better understand the EIC and how it applies to their specific financial situation.

Conclusion

IRS Publication 596 Worksheet 1 is a valuable resource for taxpayers who are eligible for the Earned Income Credit. By following the instructions in the worksheet, taxpayers can calculate their EIC accurately and claim this important tax credit on their return. Using Worksheet 1 can help taxpayers maximize their refund and ensure compliance with IRS regulations. For more information on the EIC and how to use Worksheet 1, taxpayers can refer to IRS Publication 596 or consult with a tax professional.

Overall, IRS Publication 596 Worksheet 1 is a user-friendly tool that can help taxpayers navigate the complex process of claiming the Earned Income Credit and receive the tax benefits they deserve.

Download Irs Publication 596 Worksheet 1

2023 Form IRS Publication 596 Fill Online Printable Fillable Blank PdfFiller

How To Calculate Investment Income For EITC Purposes IRS Pub 596 Worksheet 1 Walkthrough YouTube

Use This Handwriting Worksheet Generator To Create Irs Publication 596 Worksheet 1